Contact

Managing your finances effectively is crucial for achieving your financial goals and maintaining financial stability. Utilizing a financial planning app like Mint can greatly simplify the process by providing you with tools and insights to track your expenses, set budgets, and generate reports. In this beginner’s guide, we will walk you through the process of using Mint to effectively manage your finances, covering important topics such as adding accounts, categorizing expenses, setting budgets, and generating reports.

Adding Accounts

Adding your financial accounts to Mint is the first step in gaining a comprehensive view of your financial situation. Whether it’s your bank accounts, credit cards, loans, or investments, Mint allows you to link and organize all your accounts in one place for easy monitoring.

- Sign up and connect to Mint: Download the Mint app on your mobile device or access it through the Mint website. Sign up for an account using your email address or by linking to your Google or Apple account. Follow the on-screen instructions to complete the sign-up process.

- Link your financial accounts: Once you’re signed in to Mint, tap on the “Accounts” tab or navigate to the “Accounts” section. From there, you can link your bank accounts, credit cards, loans, and other financial accounts. Search for your financial institution and provide the necessary login information to connect your accounts securely.

- Verify and organize your accounts: After linking your accounts, Mint will verify your credentials and retrieve your account information. Once the verification process is complete, you’ll see a list of your linked accounts. Take a moment to review and organize them by assigning appropriate labels or categories to each account.

Categorizing Expenses

Categorizing your expenses is a vital part of understanding where your money is going and identifying areas where you can make adjustments or cut back. Mint automatically categorizes some expenses, but you can refine and customize the categorization to suit your needs.

- Review and edit transactions: In the “Transactions” section of Mint, you’ll find a list of your recent transactions from your linked accounts. Mint attempts to categorize each transaction automatically, but it’s important to review and edit them for accuracy. Tap on a transaction to view its details and make any necessary changes.

- Create custom categories: Mint offers predefined expense categories, but you can also create custom categories to reflect your specific spending habits. To create a custom category, go to the “Transactions” section, tap on “Edit Categories,” and select “Add/Edit Categories.” Enter the name of your custom category, choose an icon, and save it.

- Apply rules for automatic categorization: If you have recurring expenses that Mint doesn’t categorize correctly, you can create rules to automatically assign the appropriate category in the future. In the “Transactions” section, tap on “Edit Categories,” select “Rules,” and create a new rule by specifying the conditions and the category to apply.

Setting Budgets

Setting budgets allows you to allocate your income and track your spending in specific categories. Mint enables you to set budgets for various expense categories, helping you stay on top of your finances and make informed decisions.

- Access the budgeting feature: In Mint, navigate to the “Budgets” section to access the budgeting feature. Here, you’ll find an overview of your current budgets and spending in each category.

- Create a budget: To create a new budget, tap on the “+” icon or the “Create a Budget” button. Select the category for which you want to set a budget and enter the desired amount. You can choose to set a monthly or a custom time frame for your budget. Save your budget once you’ve entered all the necessary details.

- Track your budget: Once you’ve set your budgets, Mint will track your spending in each category and provide visual representations of your progress. You can view your budgets and spending by month, week, or custom time frames. Mint will send you notifications when you’re close to exceeding your budget in a particular category.

- Adjusting budgets: If you need to make changes to your budgets, you can edit them at any time. In the “Budgets” section, tap on the budget you want to modify, and make the necessary adjustments to the amount or time frame. You can also delete budgets that are no longer relevant.

Generating Reports

Generating reports in Mint allows you to gain valuable insights into your financial habits, analyze trends, and make informed decisions about your financial goals. Mint offers various reports to help you understand your spending, saving, and overall financial health.

- Access reports: In Mint, navigate to the “Trends” section to access the reporting feature. Here, you’ll find a collection of reports that provide different perspectives on your financial data.

- Review spending trends: The “Spending” report is a useful tool to understand your spending patterns across different categories. It provides visual representations of your spending over time, allowingyou to identify areas where you may be overspending or where you can potentially save. Explore the different categories and time frames available to gain a comprehensive understanding of your spending habits.

- Analyze income and expenses: The “Income vs. Expense” report helps you analyze your cash flow by comparing your income and expenses. This report provides insights into how much you’re earning, how much you’re spending, and whether you have a surplus or a deficit. Use this information to make informed decisions about your financial goals and budgeting.

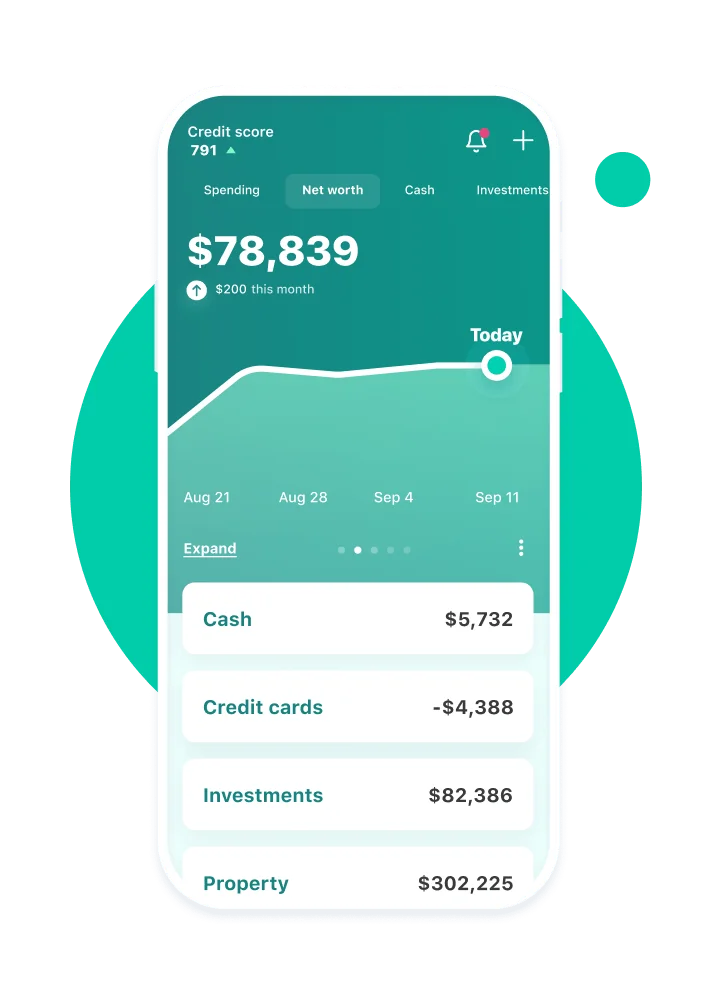

- Track net worth: Mint also offers a “Net Worth” report that tracks your overall financial health. This report takes into account your assets, such as bank accounts and investments, as well as your liabilities, such as loans and credit card debt. By monitoring your net worth over time, you can gauge your progress and make adjustments to improve your financial situation.

- Exporting reports: If you need to share or save your reports outside of Mint, you can export them as CSV files. In the report view, look for the export icon or the option to export the data. Choose the desired format and save the file to your device or cloud storage.

By following this beginner’s guide, you now have a solid foundation for navigating Mint and effectively managing your finances. Remember to add your accounts, categorize your expenses, set budgets, and generate reports regularly to gain valuable insights into your financial habits and work towards your financial goals. With Mint’s powerful features and your commitment to financial planning, you’ll be well on your way to achieving financial success.